Bitcoin bulls want to remove a major overhead resistance level to build a $55,000 course. During the early trade hours on March 3 Bitcoin (BTC) price fell by $50,000 as bulls felt that their traction had been gained and most altcoins were joining during the rally the day.

Bullish reversal of Bitcoin

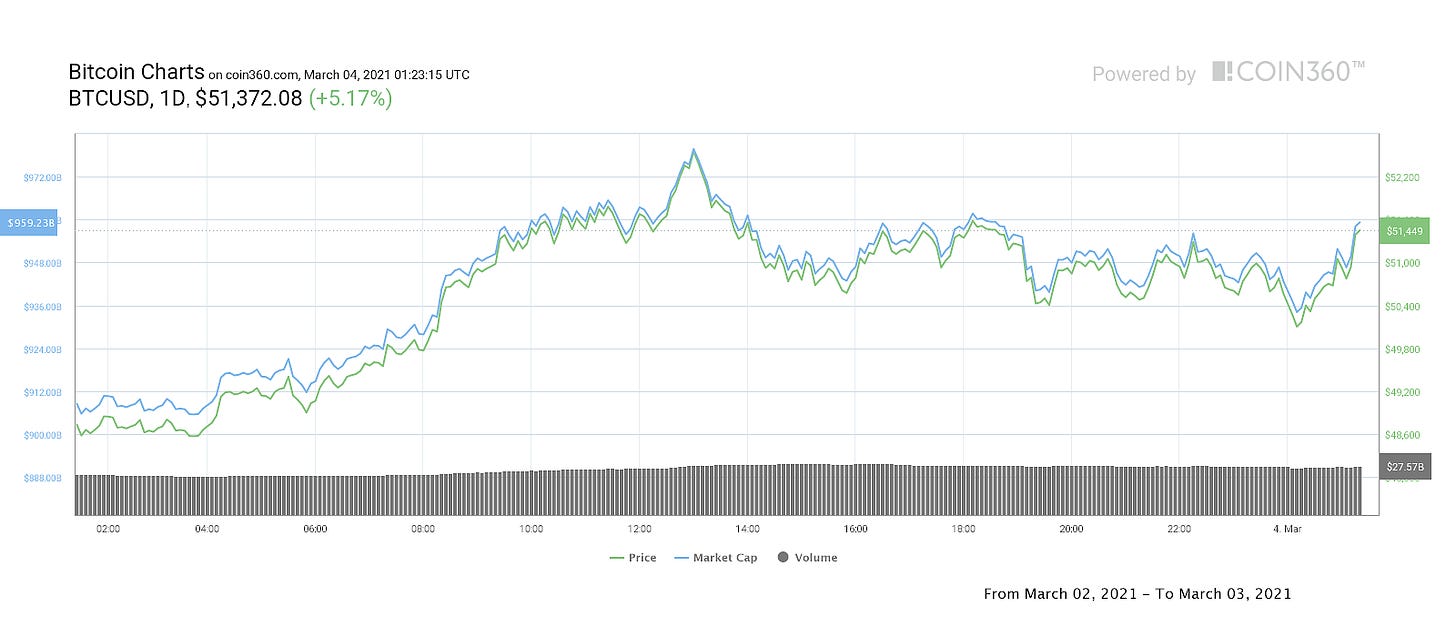

BuyUcoin Markets and TradingView data indicate that Bitcoin’s price traded at $48,500 in the early hour of March 3, before increasing by an intraday peak of 8.6% to $52,631.

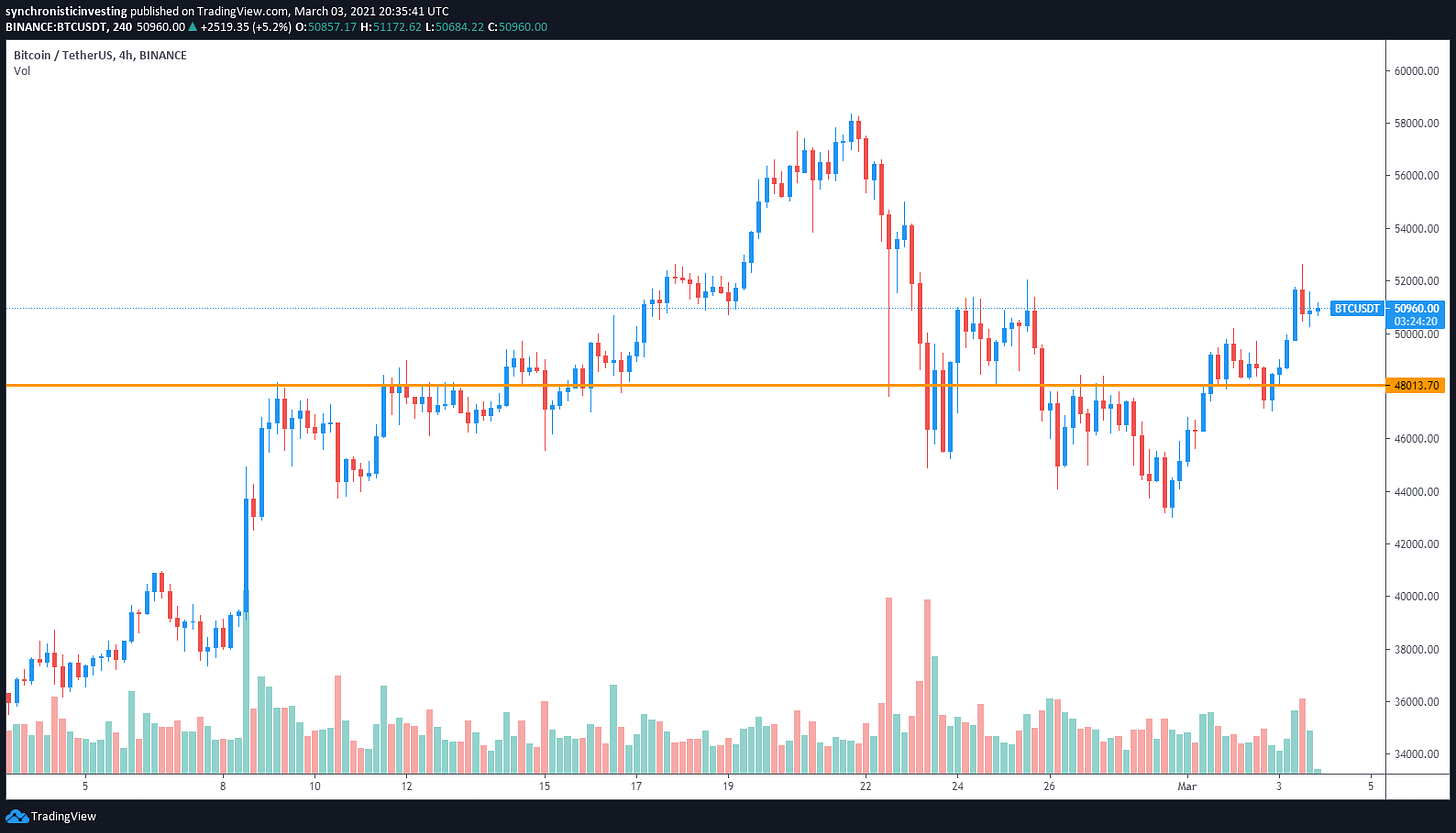

Currently, BTC market trades are marginally lower than $51,000 and while $50,000 may have been converted to soft support, regular close is needed to affirm that a bullish overhaul has taken place, above the 23.6% Fibonacci tracing ($52,000).

Bitcoin bulls want to remove a major overhead resistance level to build a $55,000 course. During the early trade hours on March 3 Bitcoin (BTC) price fell by $50,000 as bulls felt that their traction had been gained and most altcoins were joining during the rally the day.

BTC/USDT 4-hour chart. Source: TradingViewThe on-line study of CryptoQuant shows Bitcoin whales regularly bought the dips below $50,000, and the institutional buy-out of Dollars, as seen by the orange line shown on the chart above, takes place according to CryptoQuant CEO Ki-Young Ju.

The mass acceptance of Bitcoin continues with the announcement by Ninepoint Partners that they are planning to switch their Bitcoin trust offering to Toronto Stock Exchange trading fund to improve liquidity for trade and to have better trading prices.

Read more on Less than 4 Million Bitcoins Available for Buying!

Higher returns bring the traditional markets under pressure

Bitcoin’s rise above $50,000 has led observers to speculate that further penetration into global capital markets would lead to a new all-time peak. At present, the global markets are weighing bearish macroeconomic factors and that could reduce short-term expansion.

S&P 500, Dow and NASDAQ faced selling pressure all day and shut down 1.31%, 0.39%, and 2.7% after an increase in US Treasury yield in the 10-year period. Renaissance fears about the US and global health stocks were revived.

Steinglass said headwinds in the U.S. open market for BTC are the result of GBTC’s downsizing, as the GBTC discount has fallen down to around 4.5%. Despite these hurdles, Steinglass sees Citigroup and Fidelity’s latest favourable Bitcoin remarks as a good backing for the storey about rising institutional acceptance.

Steinglass said: It is really promising that Bitcoin appears to be strong even though GBTC works like a resistant band that holds it back, and I can see that the overall tale of speeding up acceptance remains unchanged.

Small and large-cap altcoins move higher

Bitcoin’s $50,000 pop has contributed to a surge in altcoins, with most of the top 100 currencies moving on Wednesday. Ether (ETH) won an intraday high of $1,610, compared to 15.7 to a day high of $21,18 for Cosmos (ATOM).

BTC/USD daily chart. Source: Coin360The breakout star of the day was Enjin Coin (ENJ) as more than 50% rose to a new all-time high of 1,32 dollars. The sharp double-digit event tends to be the outcome of Enjin’s transformation into a rising NFT marketplace and its increasing success. The global market cap on cryptocurrencies is currently $1.55 trillion and the domination figure on Bitcoin is 61%.

Read more on Large-cap altcoins triggered bull runs with Bitcoin

Bitcoin bull run is still at an early to mid-stage

The Glassnode Reserve Risk indicator says that Bitcoin’s rally is only at the start to the middle point, according to William Clemento, a crypto-currency analyst. As explained by Clemente, the price/HODL bank is identified as the reserve risk. The measure is “used at any time to determine the confidence of long-term owners in respect of the price of the native coin.”

Therefore, if the Reserve Probability continues to be comparatively low compared to previous highs, Bitcoin is not in danger of reaching a macro top. At present, the Bitcoin Reserve Risk stands at half the amount in 2013, 2014 and 2017, when the Bitcoin Price collapsed by well over 50% and the Bear Market entered.

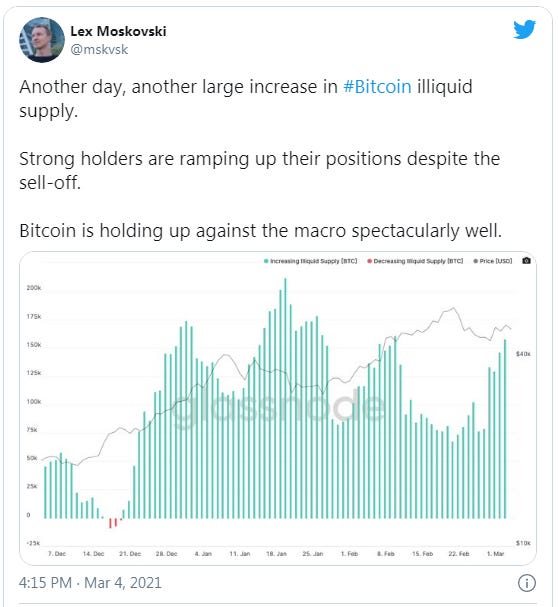

The CEO of Moskovski Capital, Lex Moskovski, observed as well that strong investors are increasing their Bitcoin positions. As long as Bitcoin continues to accrue from heavy hands and high-net-worth holders, the bull market will probably remain intact.

Furthermore, Bitcoin remains a compellingly strong timeframe trading structure, since it ran over $46,000 and is becoming a new strategic help. In addition, in view of Bitcoin’s volatility over the last 20 hours, the global financial market has declined significantly.

Kyle Davies, Three Arrows’ co-founder, noticed that the macro soldered globally, but as a consequence Bitcoin did not see a massive shift. For example, on 3 March, a big sale was seen by major tech stocks and favourite stocks like Tesla. As a result, most risk-on assets have fallen in tandem with global macro market weakness.

Read more on Tesla and JP Morgan on Bitcoin

Check Latest Posts on Crypto & Blockchain

- How to Earn Yield on Bitcoin Against Runes CollateralThe total value locked in decentralized finance (DeFi) has surpassed $122 billion, and BTCFi is carving out a bigger share of the market. HODLing BTC is no longer just about a long-term strategy—it’s about putting your bitcoin to work. Now, instead of letting it sit idle, you can earn yield on your native BTC. A…

- Top 5 Ethereum NFT Marketplaces to Check Out in 2025Ethereum non-fungible token (NFT) marketplaces have made it easy for creators and collectors to trade NFTs. Read on to discover the top five Ethereum NFT marketplaces to check out in 2025 if you want to collect NFTs or mint your collection. Magic Eden The Magic Eden NFT marketplace is one of the top platforms for…

- How Indian players can use UPI and Paytm for online casino paymentsThe massive increase in popularity of online casinos in India in recent years stems primarily from the simplified transaction process. Payment options for online casino players have evolved beyond international gateways and complex banking procedures. The introduction of the Unified Payments Interface (UPI) and Paytm has made money deposits and withdrawals at online casinos easier…

- What’s all the buzz around meme coins? Let’s find out together.

Meme Coins Explained: Short Yet Useful Guide For Those Doubting To Include Them In Portfolio Meme coins are actively being forced on social media. They are bought not only by ordinary users, but also by major bloggers and world celebrities. Some even manage to earn money on this cryptocurrency. Maybe you can do it too?…

Meme Coins Explained: Short Yet Useful Guide For Those Doubting To Include Them In Portfolio Meme coins are actively being forced on social media. They are bought not only by ordinary users, but also by major bloggers and world celebrities. Some even manage to earn money on this cryptocurrency. Maybe you can do it too?… - Ethereum in Sports: Tokenizing Athletes and Building New Fan EconomiesThe sports industry has consistently relied heavily on fan involvement, commitment, and the relationship between the athlete and spectator. Recently, with emerging technologies such as Ethereum, the fans and athletes have been offered more unique features. Managing tokens as athlete sponsors and building new fans using one of Ethereum’s many decentralized applications is bringing the…