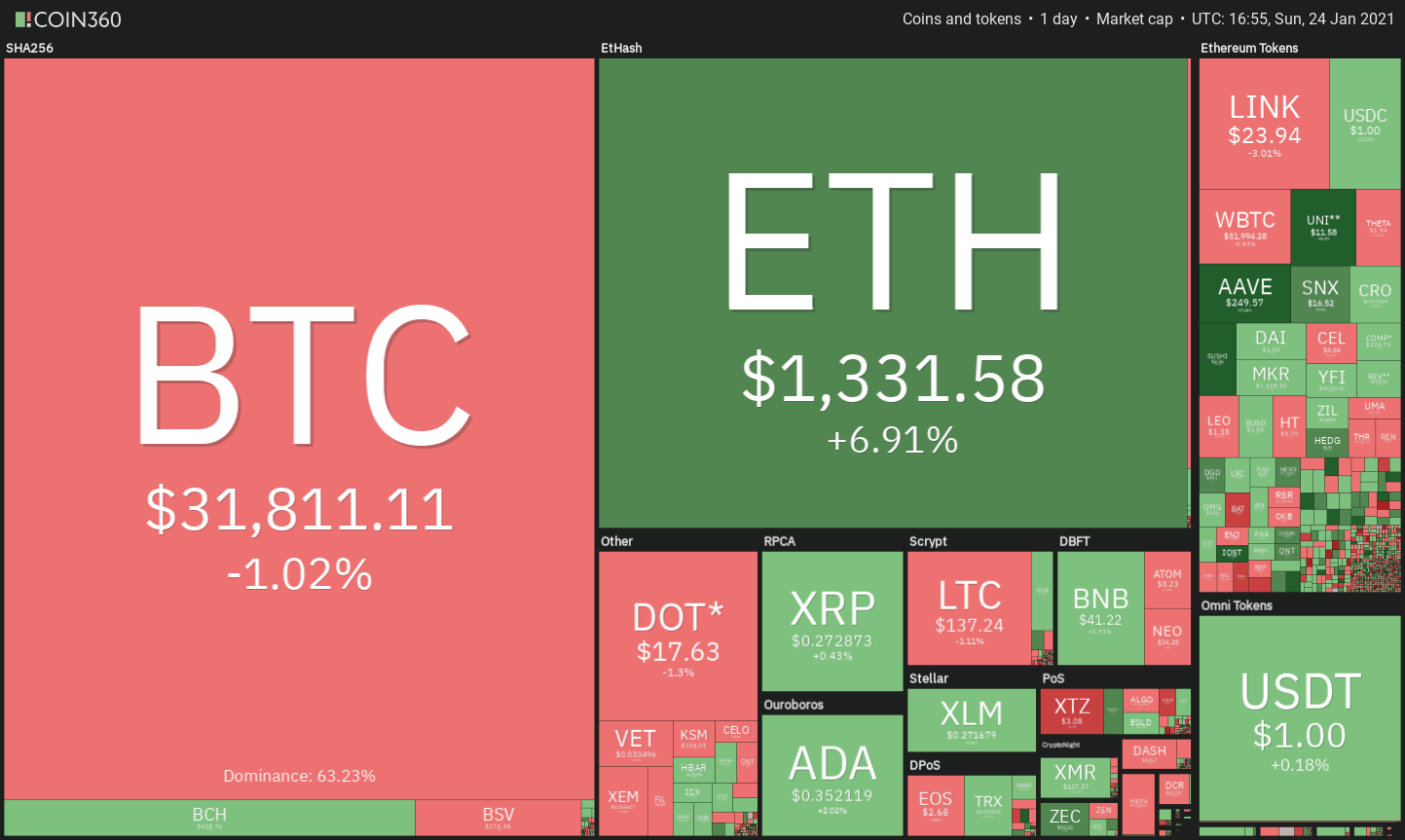

As Bitcoin price trade sideways, traders are keeping an eye out for new purchases from institutional investors in order to gauge whether BTC‘s correction is over. MicroStrategy’s recent purchase of 314 Bitcoin at an average price of $31,808 is a mild sentiment booster but it may not be enough to arrest the decline if buyers do…

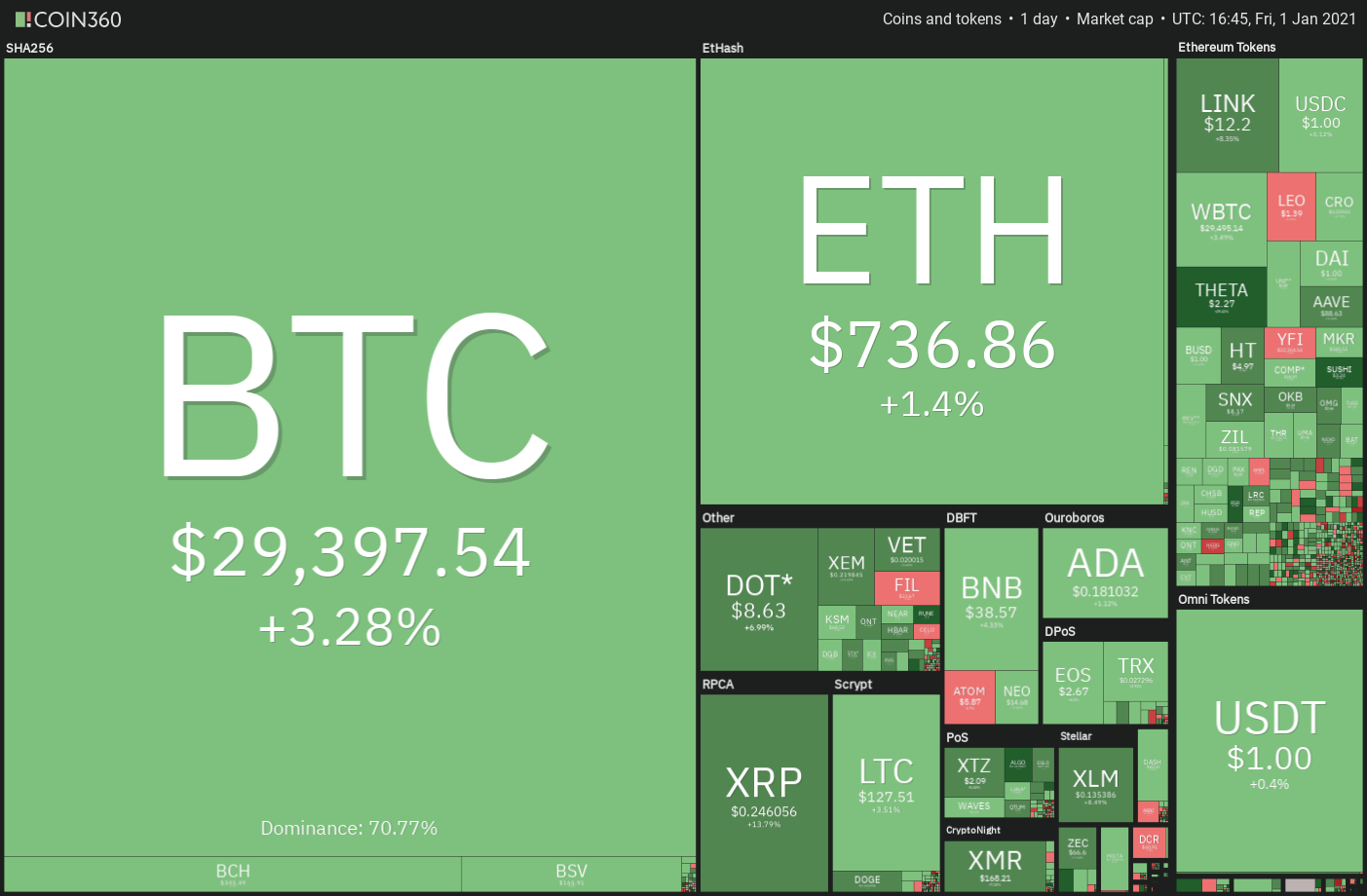

Top 5 cryptocurrencies to watch this week: BTC, ETH, DOT, AAVE, SNX