Crypto derivative platform BitMEX’s struggle with the American authorities took a toll on Bitcoin and Ethereum markets.

The US Commodity Futures Trading Commission on Thursday filed criminal charges against the owners of BitMEX, accusing them of facilitating money laundering and other illegal financial transactions. The news prompted derivative traders to withdraw more than $25 million worth of Bitcoin from their accounts on BitMEX.

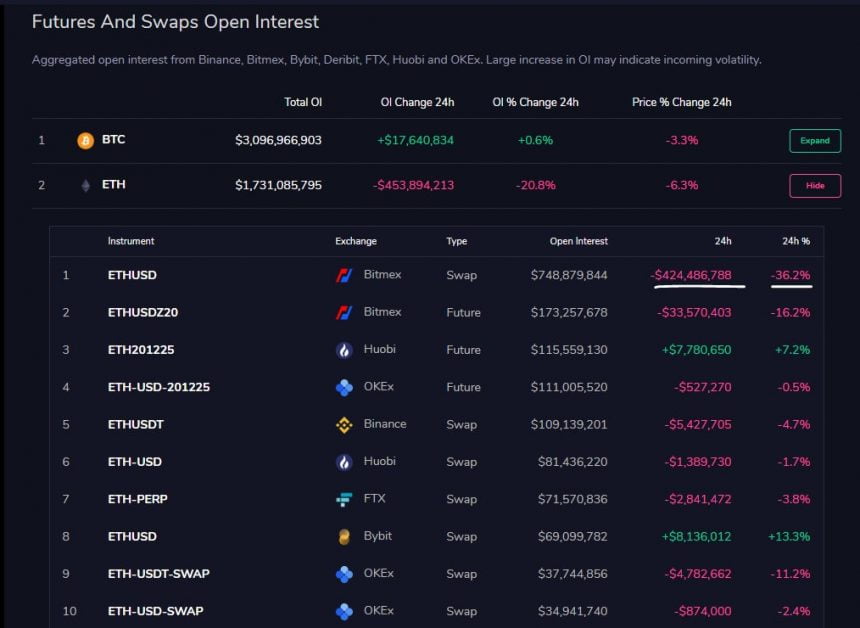

At the same time, the open interest in the Seychelles-based exchange also dropped significantly, with Bitcoin and Ethereum contracts reporting $100 million and $424 million liquidations, respectively, as of this Friday morning session.

The liquidations followed a dramatic drop in the prices of both Bitcoin and Ethereum. BTC/USD on Friday fell to a multi-week low near $10,363 in a 4.46 percent sell-off. On the other hand, ETH/USD posted more losses by dropping 9.5 percent from its Thursday’s peak.

Buy the Bitcoin Dip

Simon Dedic, the co-founder of crypto-focused research firm Blockfyre, said that both Bitcoin and Ethereum fell because of negative media coverage concerning BitMEX. He noted that the assets have a strong likelihood of retaining their bullish bias as long as “smart people” buy the dip.

“Once you understand media is nothing but a powerful market manipulator, you can start counter trading it,” said Mr. Dedic. “Non-reflecting people panic dump with fear radiating news, smart people make bank on it. Buying every dip of BTC & ETH, FA hasn’t changed.”

With FA, Mr. Dedic was referring to the cryptocurrencies’ long-term fundamental aspects. Both Bitcoin and Ethereum surged higher this year after taking cues from global central banks’ expansionary monetary policies. The Federal Reserve, in particular, fueled the crypto rally by announcing ultralow interest rates and infinite bond-buying programs.

Ethereum, meanwhile, outpaced the Bitcoin price rally because of its association with the emerging decentralized finance industry. As a blockchain project, Ethereum supports a majority of DeFi and stablecoin projects on its public ledger.

Upside Intact

A common perception across the crypto market rubbished the recent sell for its ability to mature into a long-term bearish trend. Like Mr. Dedic, other observers noted that Bitcoin and Ethereum could surge higher despite the latest setback.

“Any upside on bitcoin will get sold into until sub 10k,” said a pseudonymous trader. “The only invalidation is a clean break back above the Monthly open ~ 10.8k Higher timeframe I’m stupid bullish and dips into 8-9k I’ll be a big buyer.”

Ethereum’s positive correlation with Bitcoin also ensured a similar upside outcome for ETH/USD.