<strong>Table of Contents</strong>

What is Litecoin?

Key elements of Litecoin include:

- Digital silver

Litecoin is regularly alluded to as the advanced silver to Bitcoin as computerized gold. It imparts numerous comparative ascribes to Bitcoin and is among the most established crypto resources in the market that actually exists in the best ten digital currencies by market cap. - Fast-paced

This alone gives Litecoin incredible promise as an investment and tremendous staying power when it comes to the fast-paced crypto market. This by itself gives Litecoin an inconceivable guarantee as speculation and a huge backbone with regards to the relentless crypto market. - Proof of work consensus

Litecoin’s code is almost indistinguishable from Bitcoin’s and incorporates both a fixed stockpile and an LTC block reward splitting like Bitcoin. Additionally, like Bitcoin, the Litecoin network is controlled by confirmation of work agreement.

How to Buy Litecoin in India?

The easiest way to get Litecoin is to buy Litecoin in India on BuyUcoin with INR or you can also buy Litecoin directly. Afterward, send them to exchange with XTZ support. BuyUcoin supports wire transfers and credit card payments to buy Bitcoin, Bitcoin Cash, Litecoin & Ethereum.

Buy Litecoin in India — Step by Step Guide For Beginners

BuyUcoin is an exchange that provides buying and selling Litecoin in India as well as other cryptocurrencies. Below is a step by step guide to buy Litecoin in India via BuyUcoin:

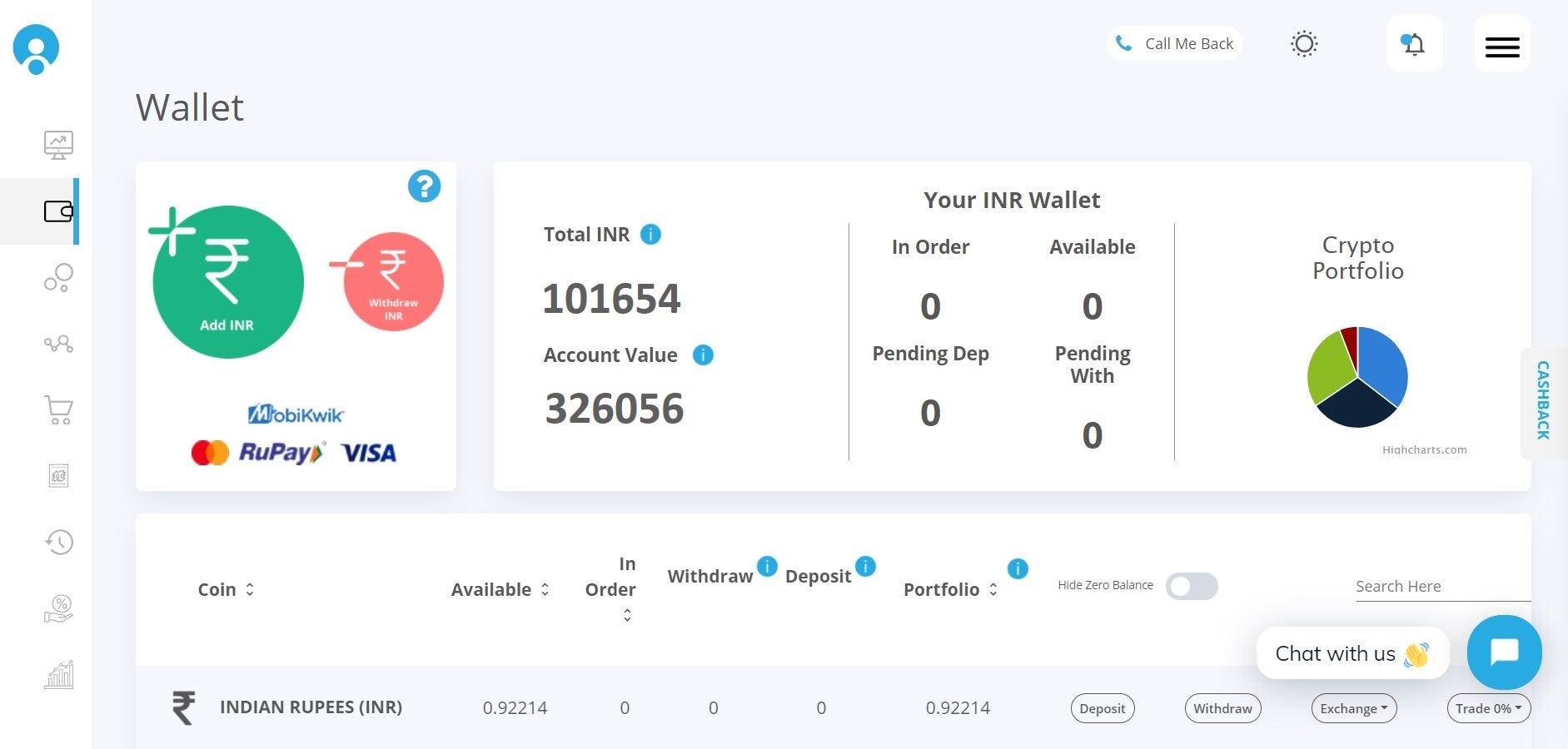

Step 1 — Open a Digital Wallet

A digital wallet is where you hold your cryptocurrencies and interacts with others via blockchain technology. There are many providers of digital wallets, however, it is important to make deep research before you decide which one is the best for you. Currently, the most popular digital wallet provider in BuyUcoin.

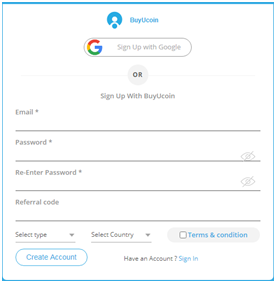

Step 2 — Register & Open an Account

Once you enter BuyUcoin/signup, register and open an account that can provide you with their service. Select the type of your account either individual or corporate. Select your country and agree to the terms and conditions to register your account for crypto trading.

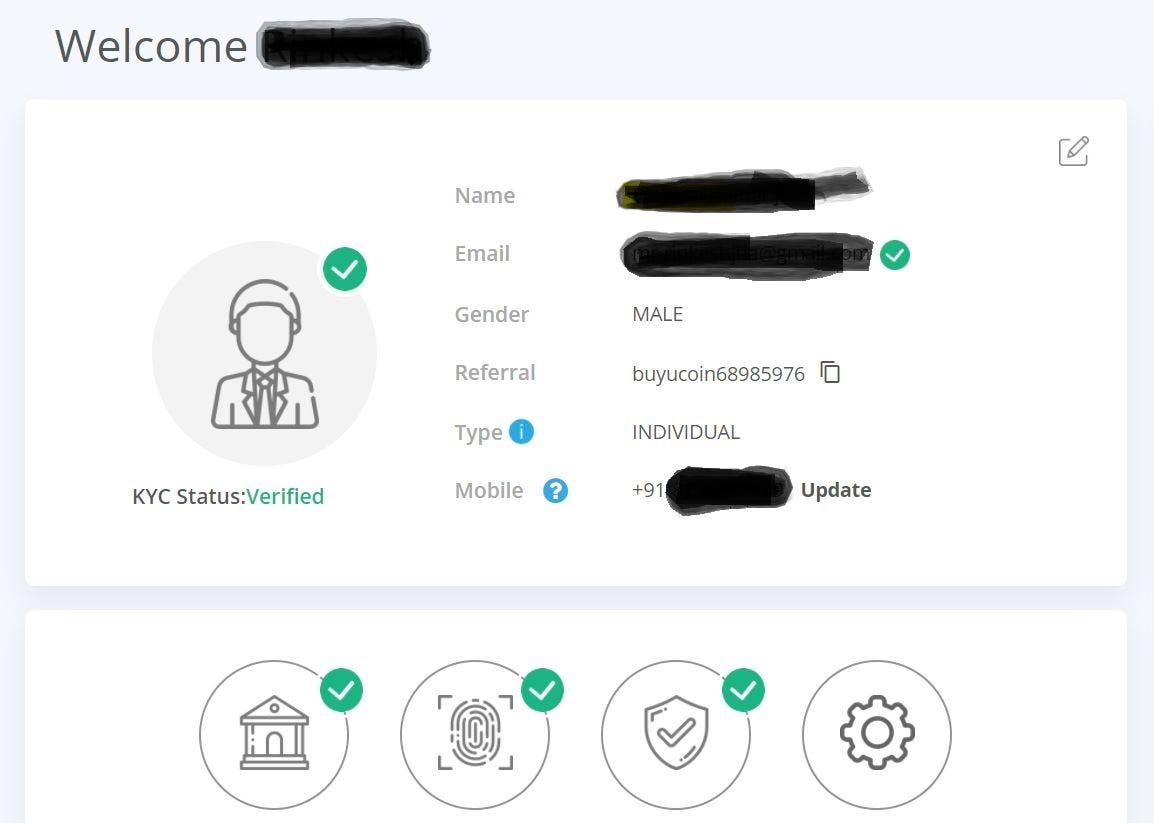

Step 3 — Complete KYC

KYC and AML are mandatory for Indian jurisdiction. Your data is safe and encrypted and is stored in Indian data centers only. You will be redirected to a different URL to complete your KYC. Please be ready with your recent selfie. You will need the images of your pan card. You will need the mobile number with you which is linked with your Aadhar.

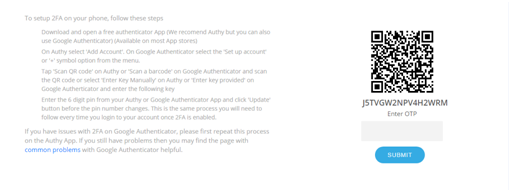

Step 4 — Google 2 Step Verification

To use 2FA you will have to install an Authenticator app on your smartphone or tablet. Once enabled you will be asked to provide an additional six-digit one-time password along with your email and password every time you log in to your BF account. This works only when signing in with an email and password. When using Facebook or LinkedIn you can enable 2FA with your social media provider settings.

Step 5 — Add Bank details

Add the credentials of your bank name, holder account name followed by account number, and IFSC code details. then you can buy litecoin in India easily with INR.

Trade Litecoin in India

As opposed to purchasing and holding a resource, financial specialists can become merchants and attempt to benefit from value vacillations. Here are the two fundamental techniques for exchanging.

Spot exchanging: Spot exchanging includes purchasing a resource at lows and selling a resource when high, wanting to remove as much benefit from each swing. In any case, when markets are declining, the main choice is moving to money while the resource value falls. It is extremely unlikely to bring in cash when markets are falling utilizing spot stages.

Brokers who purchased Litecoin at under $20 and sold at $140 would have $120 in benefit, and when Litecoin fell back to the $20 territory might have purchased the Litecoin back and still had nearly $100 to save.

Subsidiaries exchanging: Derivatives exchanging is a choice to spot exchanging that allows brokers to long or short the market, so benefits are conceivable regardless of what direction patterns turn. CFDs that permit influence can make yearning or shorting Litecoin significantly more productive by intensifying returns. This likewise builds hazard, so make certain to depend on the danger of the executive’s systems.

Utilizing 100x influence, the two $120 value swings and unpredictability might have brought about benefits as high as $24,000.

Can I Use Regular Money to Buy Litecoin?

Yes, of course, you can buy Litecoin using regular money using BuyUcoin. Litecoin is a good investment. There is no preferred time over the present to put resources into Litecoin and other cryptographic forms of money while costs are still low, and the upturn hasn’t completely grabbed hold. Purchasing en route up might be a more secure technique, in any case. However, the most monetary prize comes from being early and setting up your long exchange before things start to move.

Getting a Litecoin Wallet

Purchasing and holding cryptographic money like Litecoin and other altcoins include first buying the resource on a spot trade and moving it to a web wallet or equipment wallet for safe stockpiling for what’s to come.

Such a contributing takes minimal sum to expertise or exertion yet leaves expected benefits on the table. For instance, in 2019, Litecoin rose from under $20 to $160. In 2020, it fell back to under $40. The individuals who purchased and held would have passed up generous benefit openings.

Litecoin Exchanges in India

Litecoin likewise brought the square age time down to 2.5 minutes versus ten, making Litecoin a quicker answer for shipping off and from. It has made Litecoin a favored technique for sending crypto to and from trades, while Bitcoin is presently utilized more as a store of value.

Investing in Litecoin, as other crypto resources, should be possible either by mining or purchasing LTC online in a couple of straightforward snaps on the digital money exchanging stage or trade. When you have Litecoin, you can choose the different approaches to put resources into crypto.

Investing in Litecoin should be possible in a couple of snaps and only a few minutes on any crypto trade or digital money exchanging stage. Some exchanging stages, similar to the Bitcoin-based edge exchanging stage PrimeXBT, first requires the acquisition of BTC. Clients would then be able to open up positions utilizing Litecoin CFDs for the most conceivable benefit opportunity.

Litecoin mining

Litecoin mining possibilities: India needs to enter race before it heats up. The motivation for mining is that the primary excavator to effectively check a square is remunerated with 50 Litecoins. The number of Litecoins granted for such an undertaking diminishes with time. In October 2015, it was divided, and the splitting will proceed at ordinary stretches until the 84,000,000th Litecoin is mined.

However, might one be able to deceitful excavator change the square, empowering the equivalent Litecoins to be spent twice? No. The trick would be recognized quickly by some other excavator, mysterious to the first. The best way to really game the framework is to get a larger part of excavators to consent to deal with the bogus exchange, which is essentially unthinkable.

Conclusion

When cash arrives at a minimum amount of clients who are sure that the money is in reality what it speaks to and presumably won’t lose its worth, it can support itself as a technique for installment.

Litecoin isn’t anyplace close generally acknowledged, as even its own authors concede that it has less than 100,000 clients (even bitcoin presumably has not exactly a large portion of 1,000,000 complete clients).

Yet, as cryptographic forms of money become all the more promptly acknowledged and their qualities balance out, a couple of them — potentially including Litecoin — will arise as the standard monetary forms of the advanced domain.

Source:- Medium