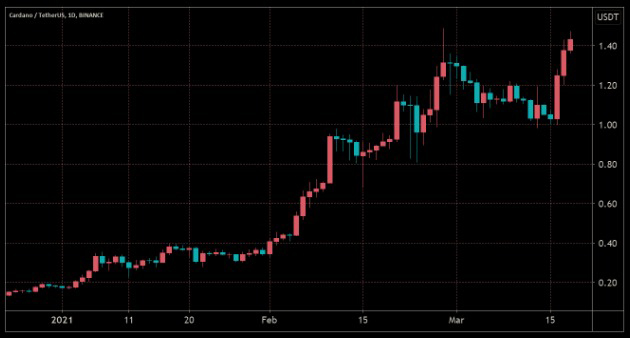

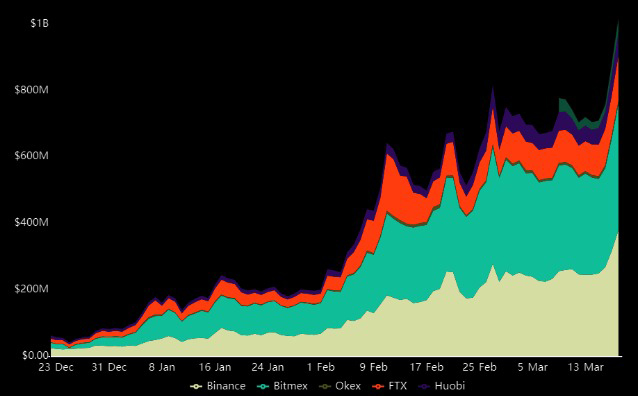

The coin base listing by Cardano (ADA) was a sign that investors have been seriously interested in ADA, and helped to push the open interest of futures contracts above $1 billion. Cardano (ADA), who had broken the psychological barrier for 1$ and achieved a record high of 1.50$ all-time, had an imposing start to the year.

Cardano(ADA) in 2021

As the network was turned into a multi-asset network similar to that of Ethereum, the impressive 590% increase took place every year. This could well bode for the future of Cardano.

The final rally appears to be linked with the announced listing of Coinbase Pro on March 16, which led, on March 18, to a renewed push for $1.47. With the price of Cardano (ADA) increased, the spot volume and on-line transfers of Cardano (ADA) exceeded Litecoin (LTC). Cardano’s increasing interest in investors has also led to a five-fold increase in future Cardano (ADA) contracts in 2021.

Don’t be fooled, breaking the $1 billion open barriers to investment is an accomplishment of only (BTC) and Ether. In addition, only three months ago, Ether had an open interest of $2 billion.

There is, consequently, a need to compare its spot volume and chain metrics against other Altcoins to understand whether Cardano really merits the third position in the market capitalization ranking.

Check out Cardano (ADA) Price now!

ADA trading volume and on-chain metrics strengthen

Whatever the price movement, a small user base or lack of newcomers reflects a low trade activity. One should therefore expect that the volume of Cardano will be amongst the top five.

The transparent exchange volumes from Nomics show that ADA had $97.5 billion in 2021, exceeding Polkadot (DOT), Ripple (XRP) and Litecoin trading volumes. While this is promising, one should also explore online metrics in order to understand whether future open interest and location volume reflect this network activity.

A more detailed view of network use is provided by daily active addresses. But this information cannot be blindly trusted. The higher the fees, the less stimulus the number has to be inflated.

Cardano Vs Other Top Cryptos

Cardano seems to be definitely disassociating itself from other Altcoins to 85,000 active daily addresses. In addition, the numbers produced seem to be indicative of their growth path, as they appear organic and are consistent with volume activity.

If these addresses were active, transfers and transactions should be assessed or the total value circulating effectively on each network. This time around, the strength of Cardano is fully demonstrated by the average network day to day transactions and transactions of $4.5 billion a day.

That is six times as much as the other competitors at least. The online activity of ADA therefore provides some support for market capitalisation at $45 billion. On March 16, before the recent price rise, VORTECSTM data from the Cointelegraph Markets Pro began detecting ADA’s bullish prospects.

VORTECSTM’s exclusive score for Cointelegraph is a combination of data, including the sentiment of the market, trading volume, recent prices and Twitter activity, in an analogous comparison of the historical and current market situation.

On 16 March, 12 hours before the announcement of Coinbase, the VORTECSTM score had recorded a high of 66. The cryptocurrency then increased to 1.23$, an 18% gain as the signal appeared.

Cardano can take advantage of the challenges caused by the congestion of the Ethereum network in volume and data in the chain. ADA prices could be declined without actual cases of use involving decentralised applications or bridges to interconnectivity that solve the problems of decentralised financing scaling.