Overnight, the recovery of Cryptocurrencies accelerated as the global market cap approaches a new historic milestone. New records have been set by Wall Street, too. On the wave of bullish news from institutional investors, cryptocurrencies were emerging yesterday from a patchy recovery.

The global market cap of cryptocurrencies

The global market cap has increased to 4.65%. It’s currently in a $1.85 trillion whisker set last weekend in the previous all-time market. In comparison to the gold market cap, the boom in asset prices also saw digital currencies gain in importance. Today, 25% of the gold market cap is the value of all crypto assets, up from 20% just a month ago.

The bull run of Cryptocurrencies

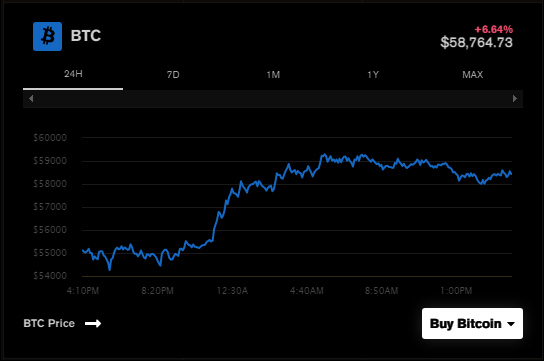

The main charge is Bitcoin, which is 4.9% more than $5,000 in the last 24 hours. The price was supported by the Chinese news company Meitu, which acquired Bitcoin and Ethereum worth $49 million.

The acquisition takes the holding of the company to approximately $90 million and was interpreted as a positive signal for Bitcoin’s continued popularity with large companies. Morgan Stanley, who spoke about big corporations, joined the BTC fray, the first large US bank to open access to Bitcoin funds for their wealthy clients.

Bitcoin went on an accusation almost as soon as these stories broke. However, Ethereum’s profits were modest. It has increased its market capital by 1.8% and is firmly within the range of 1,800 dollars.

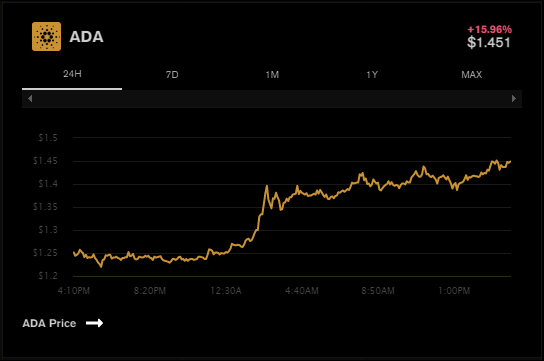

Cardano, the rising star of this week, added another 10% to yesterday’s 20% gain. While the project traded places with Binance Coin, former cryptocurrencies taxation who had a late purple patch, Cardano now worth $2 billion more. In overnight trading, Hex and Algorand also increased by more than 10%.

New records on Wall street

After the Fed committed to its policy of aggressively buying assets, Wall Street continues to win over its stock, despite the US economy’s accelerating recovery. For the second time, the S&P 500 and Dow have sprung to record closing highs.

For a third consecutive session, the Nasdaq increased. The rise is despite the recent gains from the treasury, with the 10-year benchmark rise to an annual high of 1.68%.

Within the $1.9 trillion COVID packages of President Biden, some $242 trillion of stimulus controls have been made in total that flush the US economy with liquidity. Investors wait for the flood of consumer spending that is expected to return to normal once life returns.

Just if you asked what was going on with the /WallStreetBets band of investors, they raised more than $300,000 to help save the gorillas. Aww, for example.