XRP has given up a serious percentage of its recent gains, with the cryptocurrency’s parabolic rally fading and showing few signs of strength as sellers rise with full force.

The cryptocurrency’s parabolic rally came about shortly after it plunged to lows of $0.23 before rallying to the top of its multi-year trading range around $0.30. The break above this level came about swiftly and allowed it to see some immense momentum.

Adding fuel to this sharp price rise was mounting hype surrounding the airdrop distributed to XRP investors yesterday, which was widely thought to have the potential to provide holders with some valuable tokens – similar to the airdrop seen by Uniswap.

This created a buying frenzy that boosted XRP’s technical strength and ultimately led it to highs of $0.90 on Coinbase, at which point it lost its momentum and began reeling lower.

It has been unable to gain any strong momentum in the time since and is still flashing some signs of weakness as bulls struggle to maintain its recent momentum.

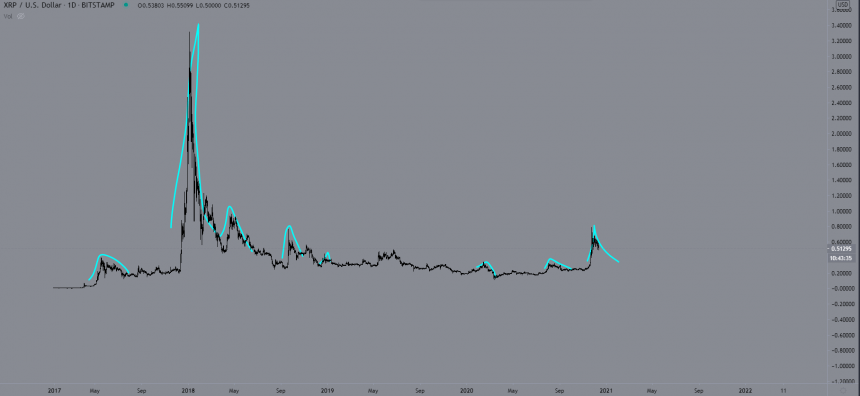

One analyst is pointing to this latest rally and noting that it is structurally similar to those seen in years past that have always resulted in full retraces.

XRP Plummets Following SPARK Airdrop

At the time of writing, XRP is trading down nearly 6% at its current price of $0.50, which appears to be a support level for the token.

It does appear that the airdrop was a “sell the news” event, as it started reeling lower right around the time of which the SPARK snapshot was taken of XRP balances on platforms that are supporting it.

Because the crypto is now showing signs of technical weakness, it could be a matter of time before it drifts back towards its multi-year trading range.

Trader Claims Latest Pump is Structurally Similar to Previous Ones

While sharing his thoughts on where XRP might trend in the mid-term, one trader noted that the cryptocurrency’s latest rally is shaping up to be just like all the others.

This means that it may see a swift decline in the days and weeks ahead as traders take profits on this movement.

“Whole lot of noise about XRP the past few days for a chart that’s slowly filling it’s inefficiency like it’s done every time in the past.”

Image Courtesy of Chase_NL. Source: XRPUSD on TradingView.

Regardless of where Bitcoin and Ethereum trend in the mid-term, there’s a strong possibility that XRP will see serious losses as long-term investors use this rally as an exit opportunity.

Featured image from Unsplash. Charts from TradingView.