Bitcoin price just set a new all-time high today, and then immediately dropped $500 and is trading below the former peak once again. Murmurs of a “double top” scenario have been making rounds across the speculation-driven crypto community.

However, one well-known crypto trader and analyst explains why such a scenario is nearly impossible, due to the requirements involved in confirming the technical chart pattern.

Bitcoin Sets New All-Time High, Drops $800 Immediately After

Bitcoin price set a new all-time high of $19,863 on Binance and beat the former peak on other spot crypto exchanges like Coinbase and Bitstamp, certifying the historic moment.

Within minutes of the achievement, however, the leading cryptocurrency by market cap plunged by $800 and is back holding onto $19,000 as support.

The rejection here after a new peak was set, and even before as Bitcoin has previously stopped short of a new high, sparked discussion and wild speculation over a possible “double top” scenario.

Related Reading | Bitcoin Rally Isn’t Just Institutional Driven, Emerging Markets Are Voting For Revolution

Double tops occur when an asset peaks at or around the same resistance level at the height of two rallies. The resistance that is created, can often be unbreakable and causes a complete reversal – hence being called a “top.”

But like any chart patterns, they must meet certain requirements to “confirm” as “valid,” and according to one well-known crypto trader, the scenario is just nonsense.

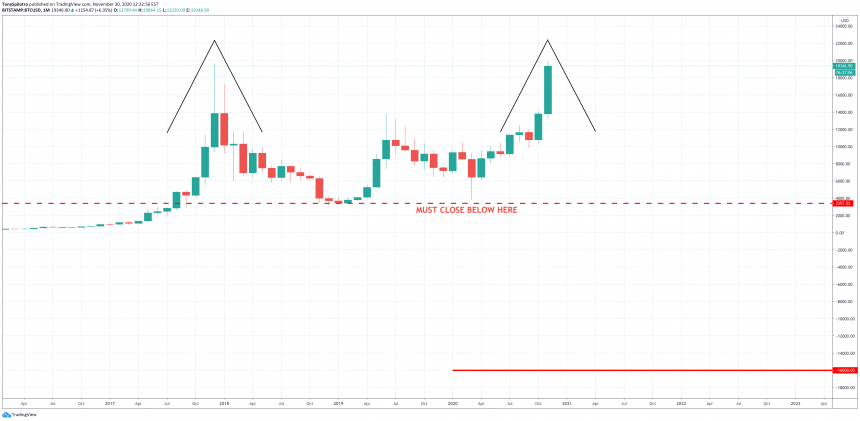

A Bitcoin double top requires bottom support to break down | Source: BTCUSD on TradingView.com

Crypto Trader Breaks Down Why BTC Won’t Double Top

According to DJ, analyst, and trader Scott Melker, who goes by The Wolf Of All Streets moniker on Twitter and elsewhere, a “double top” is extremely unlikely.

Melker explains that the requirements to confirm such a pattern as valid would require a break of the swing low between each of the two tops.

The swing low being Bitcoin’s bottom at $3,200. If Black Thursday couldn’t break it, most likely nothing will, and it becomes even more unlikely with the cryptocurrency so close to breaking out into a bull market.

Additionally, Melker outlines that the target of such a structure would be roughly -$16,000 – as in a negative price per BTC.

Unlike oil that requires a hefty cost to store, Bitcoin prices would not fall into negative territory. Zero is of course possible but is at this point less feasible than $100,000 per coin.

Bitcoin topping here isn’t all that bad, either. The first-ever crypto-asset could be forming a massive ascending triangle formation – a bullish technical continuation pattern.

An ascending triangle could be forming as Bitcoin is ahead of schedule | Source: BTCUSD on TradingView.com

According to a comparison with the last crypto market cycle, Bitcoin is currently far ahead of schedule in terms of setting a new all-time high. With Bitcoin halving theories based on a four-year block reward reduction mechanism, market cycles are expected to follow a somewhat similar trajectory.

Related Reading | Here’s What Will Happen To Altcoins Once Bitcoin Breaks $20,000

This could imply that either there will another stretch of consolidation around current prices for the next three to six months, or that the macroeconomic environment due to the pandemic and out-of-control money printing, could be having that dramatic of an impact.

If that’s the case, being concerned with a “top” around $20,000 could be as foolish as Melker makes it out to be, as the cryptocurrency’s momentum will take it much higher before the next peak is in.

Featured image from Deposit Photos, Charts from TradingView.com