Ethereum recovered above the $380 and $385 resistance levels against the US Dollar. ETH price is struggling to clear the $400…

Ethereum is Struggling Near $400, But 100 SMA Could Trigger Bullish Break

Ethereum recovered above the $380 and $385 resistance levels against the US Dollar. ETH price is struggling to clear the $400…

Bitcoin is showing positive signs above the $10,800 support against the US Dollar. BTC broke the $11,000 level and it is…

Ethereum has been at the center of some of the largest developments within the crypto market throughout the past several weeks…

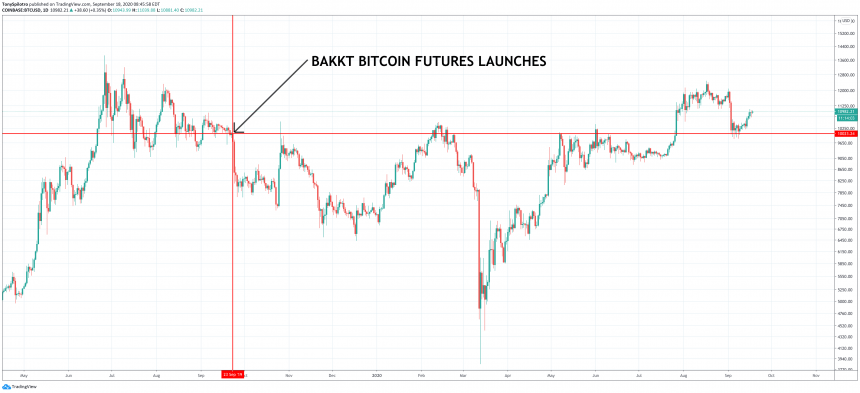

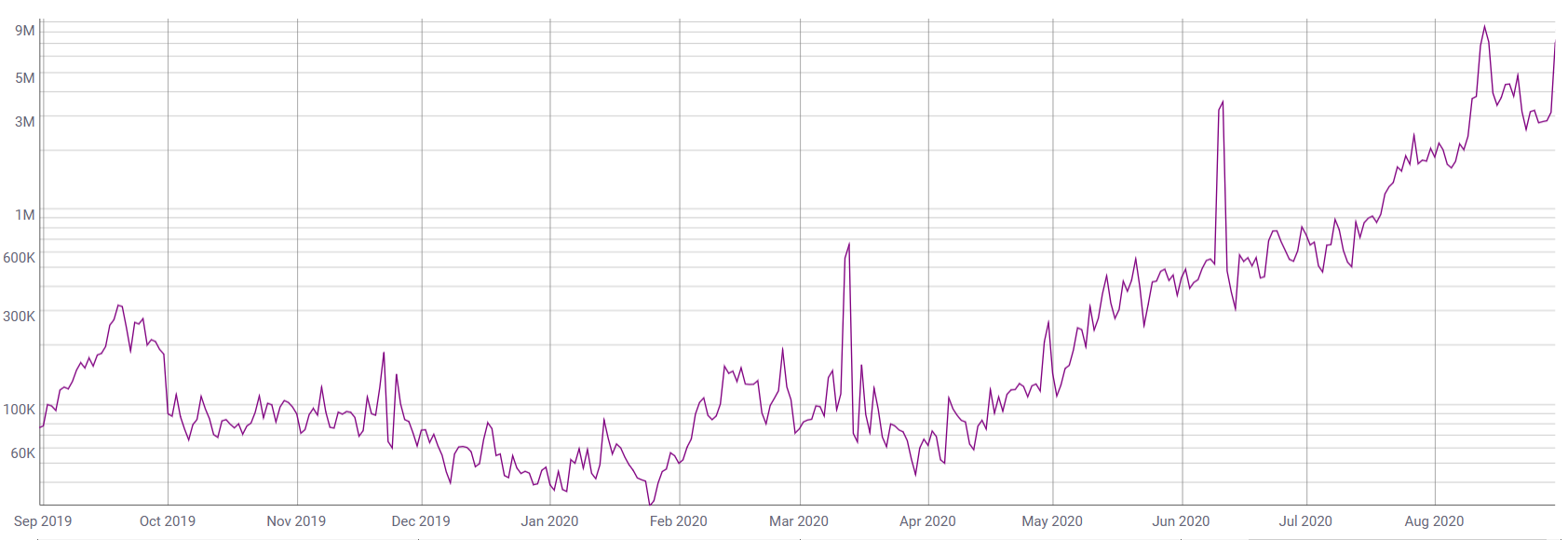

A blast from Bitcoin’s past is making a comeback, reaching a new all-time highs trading volume after abysmal launch turnout sent…

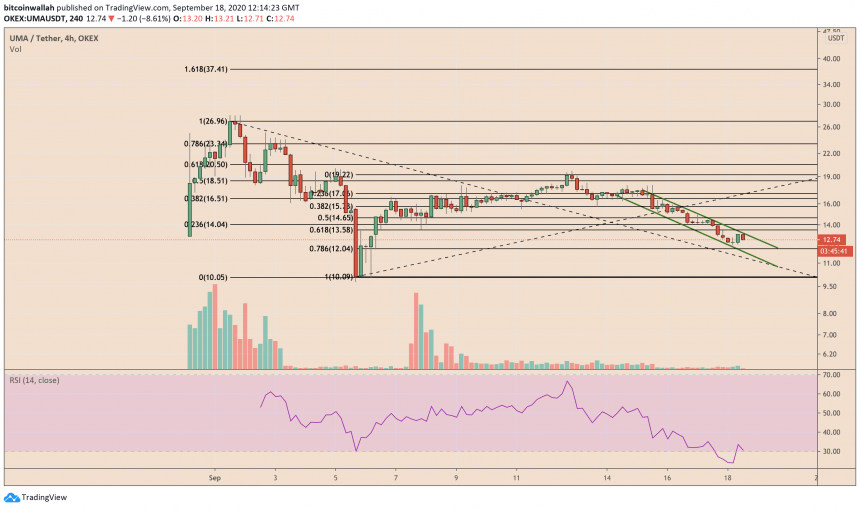

The UMA Protocol continued to lose portions of its market capitalization on Friday as its native token of the same name…

The issue of high Ethereum gas prices isn’t going away anytime soon. Just last month, total daily fees on the Ethereum…