Ethereum’s price action has been rather lackluster as of late, which has been surprising considering the deployment of the ETH 2.0 deposit contract and Bitcoin’s immense strength.

Many analysts pinpoint the weakness seen by Ethereum as the sole reason why altcoins have been bleeding out against both USD and BTC as of late.

Until Ethereum can surmount its resistance at $420, there’s a strong possibility that it will continue seeing signs of weakness and struggling to gain ground against Bitcoin.

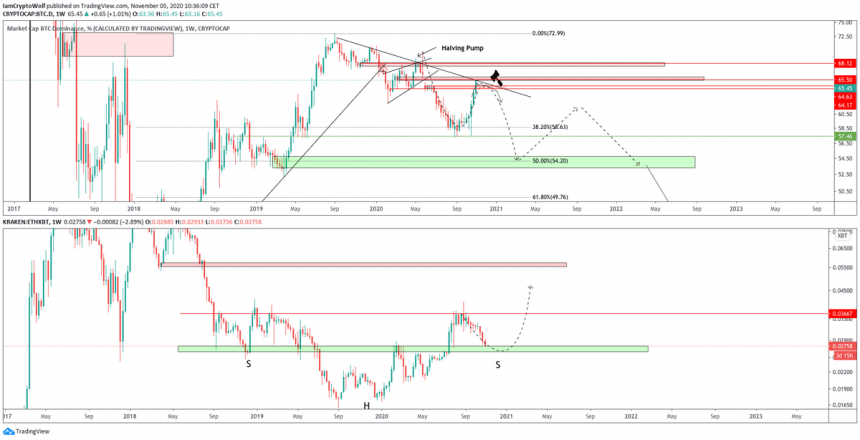

One trader is now noting that ETH is approaching a crucial level against its Bitcoin trading pair that could offer investors with serious insight into its mid-term outlook.

He also notes that holding this support could single-handedly reverse BTC’s market dominance and spark the next altseason.

That being said, the lackluster response to the ETH 2.0 rollout could indicate that bulls are fundamentally weak.

Ethereum Struggles to Break Key Resistance Despite Bullish Developments

At the time of writing, Ethereum is trading up slightly at its current price of $410. This marks a notable surge from its lows of $380 that were set yesterday morning.

The rally from these lows came about due to the deployment of the ETH 2.0 deposit contract address.

For the highly anticipated network update to occur, the contract needs to reach the ETH threshold of roughly 525,000 ETH.

Once this threshold is reached, the Beacon Chain will be launched, and the full transition to ETH 2.0 will begin.

Although this has widely been seen as a bullish catalyst, bulls’ response to yesterday’s news was relatively lackluster.

The crypto remains well below its key $420 resistance that has been holding strong throughout the past few weeks.

ETH Could Soon Trigger a Massive Altseason

While sharing his thoughts on Ethereum’s near-term outlook, one analyst explained that it is about to reach a massive support level against its Bitcoin trading pair.

He notes that this could trigger the next altseason.

“To be clear. ETHBTC is approaching key support level, if support holds BTC.dominance will reverse. Once more: ETH season will trigger [altseason].”

Image Courtesy of Wolf. Source: ETHBTC on TradingView.

The coming few days should provide investors with significant insights into where Ethereum and the altcoin market will trend in the days and weeks ahead.

Featured image from Unsplash. Charts from TradingView.