Ethereum’s price action has been rather lackluster as of late, which has been the unfortunate result of its close correlation to Bitcoin.

This correlation has suppressed its strength and caused it to see a prolonged bout of sideways trading, but it may soon help lead the cryptocurrency higher as analysts look towards it seeing further upside in the days and weeks ahead.

It still remains below a few key levels that may act as hurdles for it, including $360 as well as the region between $380 and $400.

Until these levels are firmly broken above, and ETH finds stability above $400, it may struggle to garner a decisive uptrend.

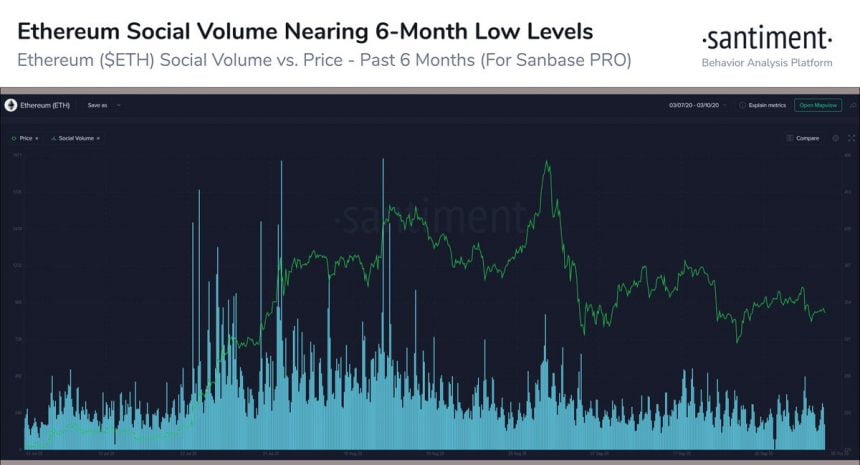

One analytics firm is now noting that sentiment surrounding the cryptocurrency is incredibly low, however, which may actually act as a counter-indicator for Ethereum’s near-term outlook.

The firm notes that declines in interest and sentiment as extreme as the one being seen now typically suggest an upside movement is looming on the horizon.

Ethereum Continues Consolidating as Likelihood of Upside Grows

At the time of writing, Ethereum is trading sideways at its current price of $353. This is slightly above where it has been trading at throughout the past few days and weeks, with it pushing higher today in tandem with Bitcoin.

This slight upwards momentum comes as the stock market begins stabilizing, which is allowing the entire crypto market to see some momentum.

If ETH continues tracking Bitcoin, then further upside could be imminent in the days and weeks ahead.

Analytics Firm: ETH Social Volume Points to Imminent Upside

While speaking about where Ethereum may trend in the days and weeks ahead, one analytics firm explained that investors growing disinterested in the cryptocurrency is actually a bullish development.

They note that periods of extremely low sentiment are typically followed by sharp upwards movements. As such, Ethereum could soon confirm its recent lows as a long-term bottom and begin ascending higher.

“The social volume of #Ethereum is nearing 6-month low levels across social discourse platforms as traders look elsewhere for volatility to trade. However, assets like ETH typically see the biggest buy opportunities when crowds are disinterested,” they explained while pointing to the below chart.

Image Courtesy of Santiment.

Where Ethereum trends in the days and weeks ahead will likely continue depending largely on Bitcoin.

Any further BTC turbulence could strike a serious blow to ETH, leading it back down towards its recent lows of $315.

Featured image from Unsplash. Pricing data from TradingView.

Get the latest information of the Crypto world on at BUYUCOIN

Square’s Bitcoin Investment Made $2 Million Over The Last 24 Hours