Non-fungible tokens (NFTs) are vying for a bigger slice of the crypto pie. In recognition of this, the VeChain Foundation promotes its platform as the best place for developers to build their NFT projects.

They claim VeChain was one of the original pioneers of NFTs. What’s more, purpose-built NFT toolsets and grants are available for those interested in porting over.

“Our blockchain offers a secure, high-speed, and stable protocol coupled with features to remove the complexities of blockchain and comprehensive support to applications with real value. Foundation Grants are also available for the migration of NFT Projects to our platform.”

NFTs can be thought of as digital collectibles. They are similar to cryptocurrency, in that they exist on a blockchain and have a monetary value.

But what differentiates them is a layer of characteristics that make them unique. For example, in the associated metadata, visually, serial numbers, and so on. All of this impacts the value of the NFT with what collectors deem valuable/wanted.

“NFTs therefore create exciting monetization opportunities for brands and collectors, as they are provably authentic, safe to trade, and can include all different types of artwork and branding opportunities.”

Non-Fungible Tokens Are Still a Niche Offering

Recently, there has been much talk of NFTs being the next big thing in blockchain.

However, some would argue they are too niche to make any sort of meaningful impact. Also, the investment potential of NFTs continues to divide opinion.

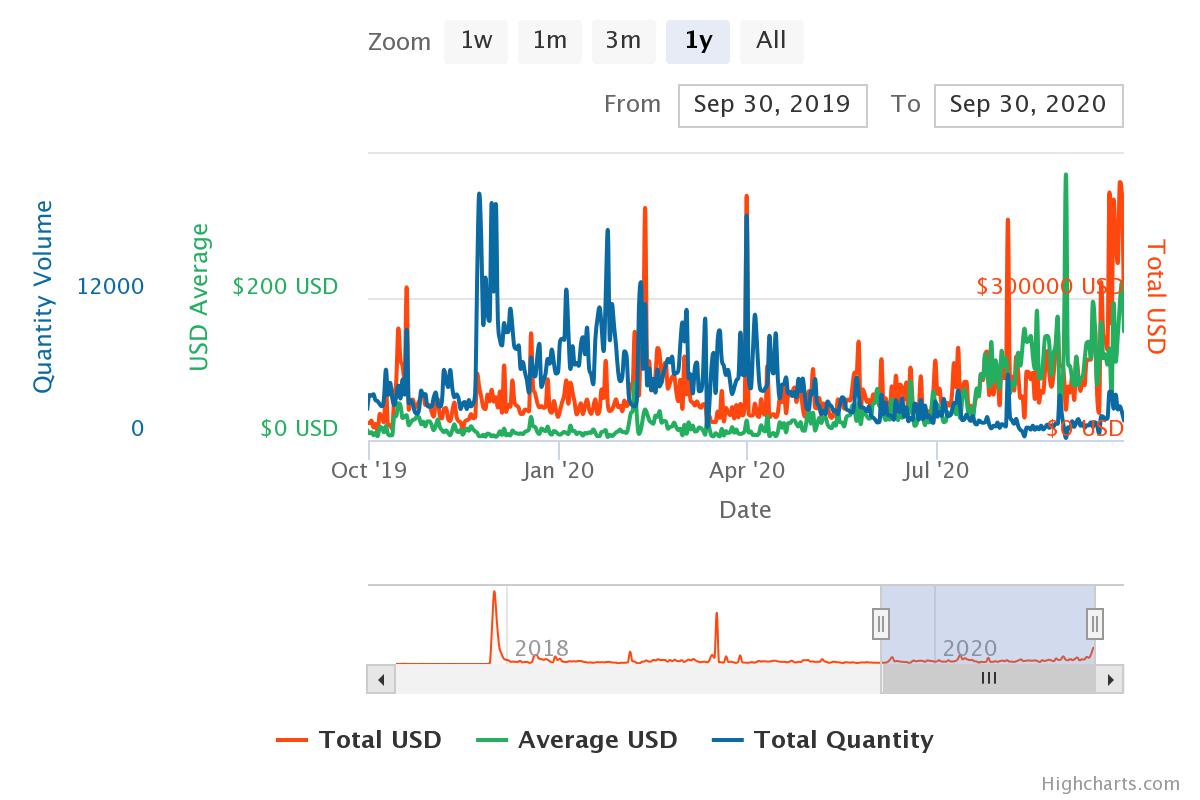

Data from nonfungible.com shows a marked uptick in total USD sales of NFTs lately. On September 27, 2020, NFTs to the value of $541k were sold. This is a year-to-date high, beating the previous high of $512k set on March 31, 2020.

Source: nonfungible.com

Considering Bitcoin’s 24-hour volume was $52 billion, NFTs, even on a good day, represent a fraction of the cryptocurrency market.

But, are things about to change?

How Can VeChain Help?

VeChain CEO Sunny Liu certainly thinks so. What’s more, Liu is pushing hard to attract more NFT projects to his platform.

“We are about to witness a plethora of new NFTs assets being minted and flooding into this marketplace. VeChain’s pioneering technology is currently the most advanced technology and provides the best features for business-oriented scenarios.”

With that, the VeChain Foundation boasts of having a dedicated NFT standard (VIP180). They claim that it significantly enhances the user experience and offers developers a secure and audited code to work with.

John Dempsey, Co-Founder, and CEO of VIMworld, who ported over to the VeChainThor blockchain, spoke of the massive cost savings made.

“Currently, we have more than 12,000 Smart NFTs distributed to our users with much more planned. If we were to run our business on Ethereum, we would have to pay more than $400,000 in gas fees alone for these transfers, and up to millions more for other operations.”

And with grants of up to $30k on offer, VTHO subsidies, as well as bug bounty programs, it’s clear that VeChain is pushing hard on NFTs.

VET daily chart YTD with volume. (Source: tradingview.com)