Bitcoin could hit a new year-to-date (YTD) high, abetted in part by the risks surrounding the US presidential election.

The analogy takes cues from a quarterly commodity outlook published by Citigroup. The American banking giant specifically based its report on gold and its potential behavior amid the election season this November. It noted that the precious metal may rise to a new yearly high, stating that the market is underplaying the asset’s ability to grow against the election’s uncertainty.

Connecting Dots

Bitcoin, which has erratically tailed the gold market since March 2020, fell this week against a similar geopolitical outlook. The cryptocurrency briefly touched $10,100 as the Federal Reserve Chairman Jerome Powell warned about their inability to support the US economy without the second coronavirus stimulus package.

The US Congress delayed the long-awaited financial aid as the Democrats and Republicans argued over the size of the help. Many economists and analysts anticipated that the second stimulus package won’t arrive before the presidential election.

Congress is poised to leave town until after the election without passing a coronavirus stimulus https://t.co/deFM9mVVpd pic.twitter.com/A37dGfdE1E

— CNN Politics (@CNNPolitics) September 23, 2020

The said delay appeared even as the US reported a historically high unemployment rate, a rise in the number of bankrupted small and medium-sized businesses, a resurgence in coronavirus cases. That further led investors to park part of their capital back into the US dollar.

It overall reduced the appeal of other safe-haven and risk-on assets. As a result, Bitcoin, gold, and stocks gave up part of their gains to the stronger dollar outlook.

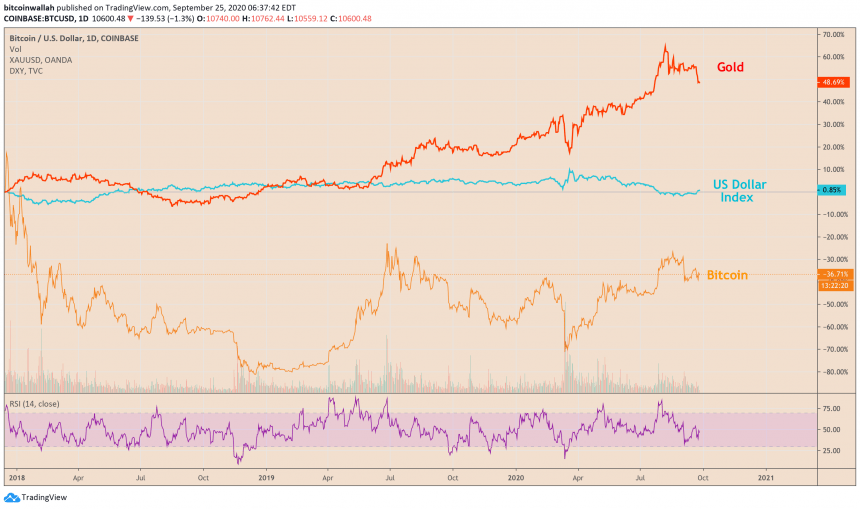

Bitcoin-Gold-DXY correlation. Source: TradingView.com

But for Citibank, there is still room to grow, at least for gold. The bank wrote in its report:

“The election could be an extraordinary catalyst for gold flat price and volatility skew late in the fourth quarter, even though historically there is no clear pattern for gold trading or price volatility into and after U.S. elections. That is one reason why we expect gold prices to hit fresh records before year-end.”

Influence on Bitcoin

The Citibank outlook of gold left Bitcoin under a similar upside spell. Its report highlighted that the safe-havens should rise as long as the Fed continues on its expansionary approach to aid the US economy. It would mean ultralow interest rates and higher growth in inflation.

Demand also expects to come from the rest of the world as global central banks strive for interest rates near or below zero. Just two weeks ago, the Bank of England discussed negative lending facilities to boost spending on market-aiding programs.

While a new influx of cash helps the households and businesses, it steals yields from the account of savers. Tyler Winklevoss, the co-founder of the Gemini crypto exchange, said that people should “long Bitcoin” to save their incomes from further depletion.

“If the Bank of England adopts negative interest rates, they would be paying you to borrow. You couldn’t buy a better advertisement for Bitcoinbut u can take their money and go long bitcoin.”

Bitcoin was trading about 45 percent higher on a YTD timeframe.