Yearn.finance’s YFI token has been consolidating within the mid-$20,000 region throughout the past few weeks, with its recent parabolic surge from lows of $7,500 getting slightly overheated after it approached $30,000.

It has since been consolidating and is now gearing up for another bout of volatility as its trading range grows narrower by the day.

Some positive underlying developments have been backing its ascent, with the ecosystem’s founder teasing the release of decentralized options contracts, as well as yields in the yVaults rocketing higher over the past few weeks.

As the DeFi trend kicks back into full gear and trading volumes on decentralized exchanges pick back up, there’s a strong possibility that yVault yields will continue increasing, thus boosting the underlying value of the YFI token.

Furthermore, the resurgence in speculative investing has also boosted the cryptocurrency, with the newly popularized DeFi tokens all seeing large inflows of capital.

So long as this trend persists, then the Yearn.finance governance token may see continued upside in the days and weeks ahead.

Yearn.finance’s YFI Token Consolidates in Mid-$20,000 Region

At the time of writing, Yearn.finance’s YFI token is trading down marginally at its current price of $24,000.

This is around the price at which the crypto has been trading throughout the past few days. The selling pressure seen at $28,000 has proven quite intense and may continue slowing its growth in the mid-term.

Until this level is broken above, the cryptocurrency might continue facing a bout of intense sideways trading.

Once this level is shattered, YFI may start its next leg higher and potentially even target its all-time highs in the mid-$40,000 region.

YFI is “Squeezing” – Which Could Mean That a Bullish Breakout is Imminent

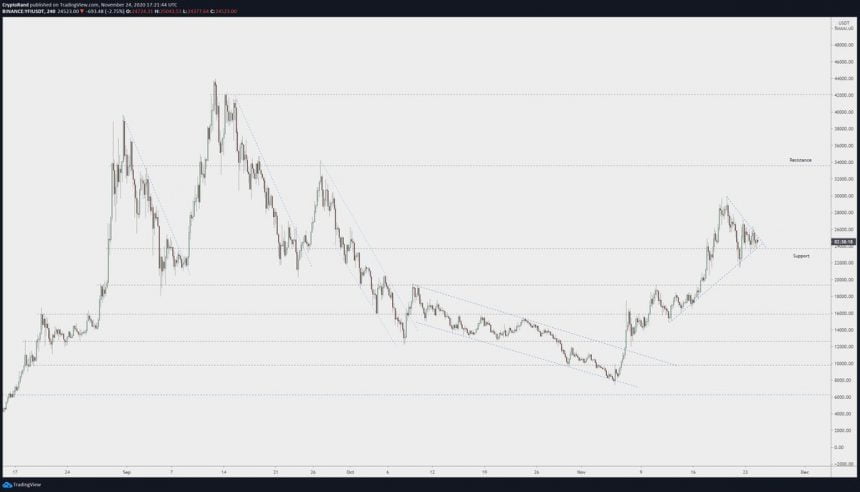

One trend that may be working in Yearn.finance bulls’ favor is that the cryptocurrency is pinched within the apex of a bullish triangle formation.

While speaking about this, one analyst explained that he is watching for a bullish break above this triangle, which, in his words, would make the cryptocurrency enter a “full bullish” mode.

“YFI squeezing, breakout would make out full bullish.”

Image Courtesy of Crypto Rand. Source: YFIUSD on TradingView.

Ethereum’s price action has been firmly guiding that of the DeFi sector. As such, the cryptocurrency must show continued signs of near-term strength for tokens like Yearn.finance’s YFI to push higher.

If ETH holds $600, YFI could be well-positioned to see an immense surge higher in the days and weeks ahead.

Featured image from Unsplash. Charts from TradingView.