The price of Bitcoin ended the week up 9.94 percent for the third week in a row.

The price of Ethereum finished the week up 17.95 percent, its biggest week since the beginning of May.

The price of XRP ended the week up 7.52 percent for the third week in a row, and for the first time since early April.

The price of Bitcoin ignores resistance, while ETH and XRP retest their breakouts. As the top 3 cryptocurrencies’ prices overcome broad skepticism and worries, the rally’s general impulsiveness has not reduced.

Bitcoin price quickly discards resistance

Bitcoin’s price has risen 54 percent since July 21, marking the third-best 20-day gain in 2021 and a 285 percent increase in the last 52 weeks. On the bar charts, the impulsive activity began with a bullish outside week at the 50-week simple moving average (SMA).

With relative ease, Bitcoin price overcame the trifecta of resistance of the January high of $41,322, the 38.2 percent retracement at $42,589, and the February 28 low of $43,016 to establish the range as critical support for BTC moving ahead.

With a positive outer day on the bar charts, Bitcoin price is now attempting to clear the strategically significant 200-day SMA around $44,983. Beyond the 200-day SMA, Bitcoin is poised to break through the BTC resistance connected with the 50% and 61.8 percent retracement levels at $46,849 and $51,109, respectively, before reaching the next serious hurdle around $57,750.

The prior triple of resistance between $41,322 and $43,016 provided critical support to the optimistic narrative. If Bitcoin fails to hold, it will be vulnerable to a challenge of the June 29 high of $36,675, as well as the 50-day SMA at $35,589.

If Bitcoin price does correct now, it should do so in time rather than price, maintaining momentum and clearing weak holders who want to lock in profits or exploit the rally to break even on previously held loss holdings.

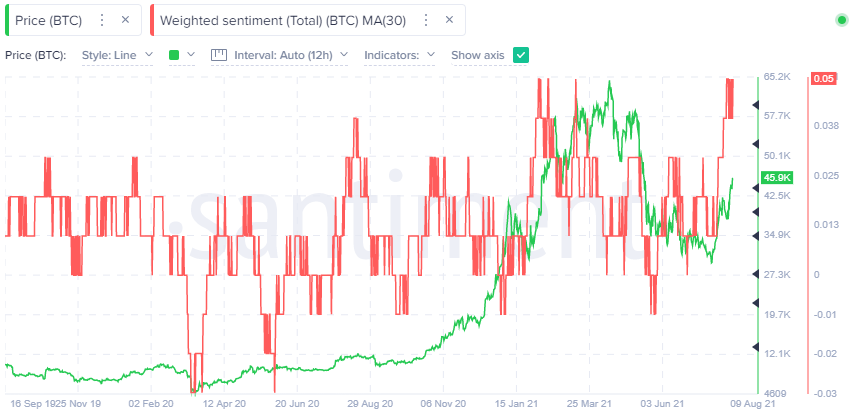

The Santiment Weighted Social Sentiment metric on a 30-hour smoothed basis is supporting a Bitcoin price decline. The moving average is currently at the same level as it was prior to the February correction and coincides with the March adjustment.

In an attempt to visualize the general sentiment of the crypto community toward BTC, the Weighted Social Sentiment identifies all daily coin mentions collected by Santiment as either positive, negative, or neutral.

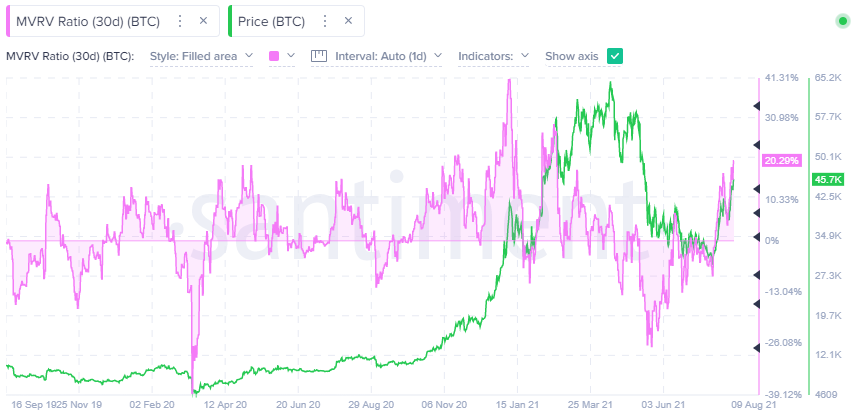

The BTC 30-day MVRV ratio is another statistic that suggests a possible Bitcoin price correction. This on-chain measure aims to calculate the average profit or loss of all addresses that have acquired BTC in the last 30 days.

The BTC 30-day MVRV ratio is at +20.29 percent, implying a gain of 20.29 percent for all addresses that have acquired BTC in the last 30 days. The greater the uncaptured gain, the higher the chance of BTC speculators reducing their exposure.

The reading of 20.29 percent is not the same as it was in January before the correction or in February before the repair. It is still close to the consolidation level from November to December.

As BTC approaches a critical resistance level, FXStreet’s analysts assess where it might go next.

Ethereum price greets London Fork with applause

Since July 21, the Ethereum price has only had two negative days, resulting in a 76.50 percent gain based on the current price. Over the last 52 weeks, ETH has increased by 626.94 percent.

The price of Ethereum closed above the price congestion formed by the June 3 high of $2,890, the May 26 high of $2,913, and the May 20 high of $3,000 on August 7, establishing a new support line for the cryptocurrency.

Despite the overbought state on the daily Relative Strength Index, if Ethereum’s price can successfully hold the newly discovered support during any consolidation, it will be free to test the all-time high in the next weeks.

Assume, on the other hand, that the Ethereum price does not hold the support. If the broader cryptocurrency market experiences selling pressure, ETH could fall to the July 7 high of $2,411 and potentially to the 2020 rising trend line at $2,300.

After attaining the target, FXStreet’s analysts examine where ETH might go next.

XRP price readies for a new bull market

After three consecutive positive weeks for the first time since the beginning of April, the XRP price has gained 54.35 percent since July 21 and is currently up 167.70% over the last 52 weeks.

After a multi-day consolidation in time rather than price, XRP price crossed the neckline and the 200-day SMA at $0.791 on August 7, trading close to the double bottom trigger of $0.733. Ripple is presently successfully testing the new support.

The measured move of the double bottom is a little over 30%, implying a profit goal of $0.953 based on the pattern trigger price of $0.733. The XRP price goal falls short of the psychologically significant $1.00 as well as the 38.2 percent retracement level of the April-June decline at $1.06. Ripple investors who bought the August 7 close would see a 30.69 percent gain if the price rose to $1.06.

The magnet effect of the 200-day SMA at $0.796 with the neckline of the Ripple multi-year inverse head-and-shoulders pattern around $0.772 is the sole roadblock in the way of the measured move price goal of $1.06.

If Ripple fails to hold the 200-day SMA at $0.796, the neckline at $0.772, and the double bottom trigger at $0.733, the XRP price will be forced to test the bottoming 50-day SMA at $0.658 or the $0.652 low from May 23.

All three cryptocurrencies have shown the impulsiveness or confidence that leads to long-term lows and rallies. However, according to the 30-day MVRV ratio, Bitcoin’s price is becoming overpriced, and the recovery has boosted positive social media comments to levels seen during prior corrections. XRP price is aggressively testing the fresh support of the 200-day SMA and the neckline, while Ethereum price is balancing a protracted gain with sustained bullish interest in the London Fork.

FXStreet’s analysts assess where Ripple might go next as it appears to be on the verge of a breakthrough.

Source: Fxstreet