Yearn Finance’s governance token, YFI, closed above $40,000 during the early trading session on Monday.

The YFI/USD exchange rate established an intraday high at circa $42,425 following a 13.74 percent rally. The strong upside move appeared despite a lackluster bullish trend elsewhere, with top cryptocurrencies Bitcoin and Ethereum trading under the weight of sellers.

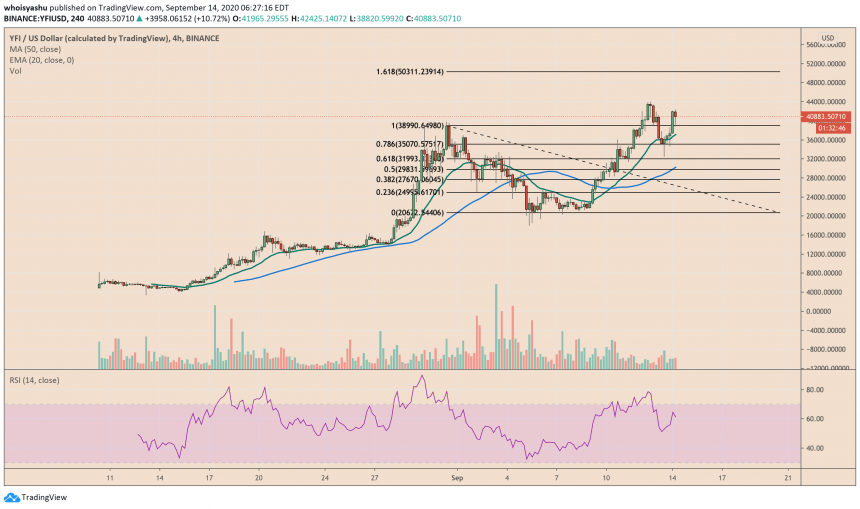

YFI too experienced a sell-off near its session top. Traders booked their intraday profits, causing the cryptocurrency to plunge lower by 8.50 percent during the European session. Nevertheless, a support level lurking around $38,990 protected the price from falling anywhere lower.

Yearn Finance is looking to reclaim its all-time high. Source: TradingView.com

YFI/USD reclaimed some of its intraday profits after establishing its session support level. A continuation in uptrend expects to lead the pair towards its all-time high near $44,003, with a primary bullish target lurking near $50,311.

Conversely, breaking below the support level risks sending the price towards $35,070, with an extended downside target at $31,993.

YFI Fundamentals

The latest winning round the Yearn Finance market followed YFI’s listing on Coinbase Pro.

The US-based crypto exchange announced earlier today that it is now allowing traders to deposit their YFI tokens into its platform. From Tuesday, trading of the DeFi cryptocurrency will commence. Excerpts from their announcement:

“Once a sufficient supply of YFI is established on the platform, trading on our YFI-USD order book will launch in four phases, transfer-only, post-only, limit-only and full trading. If at any point one of the new order books does not meet our assessment for a healthy and orderly market, we may keep the book in one state for a longer period of time or suspend trading as per our Trading Rules.”

The news served as a milestone or YFI, a cryptocurrency that had already registered a record-setting bull run–40X price appreciation–since its launch in mid-July. The rally itself came as “yield hunters” picked YFI for its ability to govern a lending aggregator that was returning $700K in profits until late last month.

Road Before

Traders flocked into the Yearn Finance protocol because YFI was practically worthless at the time of its introduction, thus cheaper to hold. But the token was still backing a profitable business model of picking the best-yielding DeFi pools for users and earning an income out of it.

“Given that most of the participants were already heavily embedded in the DeFi ecosystem, many have shifted their focus to working on Yearn Finance full time,” noted Connor Demsey of Messari.

“With an army of incentivized volunteers, yearn.finance is shipping new features like crazy. As with yearn’s yield-optimizing smart contracts, all of these new features are value accretive to YFI token holders.”

That has made traders ultra-bullish for YFI. And with a Coinbase Pro listing, the bias expects to grow further into the year.

Photo by Jeremy Perkins on Unsplash